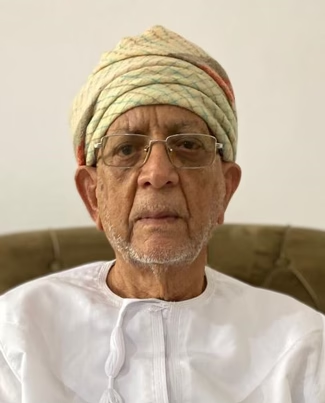

OmanObserver -Haider Abdul Redha Al-Lawati

As part of preparations for my PhD studies, I had worked on a pair of papers titled, ‘Policies and Trends in Savings in Omani Society’ and ‘Saving for the College Education of my Children’. More than 92 per cent of respondents who had been surveyed as part of my study firmly underlined the need for parents to put away funds for the higher studies of their children. This sentiment can be attributed to the fact that Omanis, much like people elsewhere around the world, are very keen to ensure that their offspring study in world-class schools, colleges and universities – local and overseas – a desire that has also fuelled the growth of public and private educational institutions.

Consequently, many Omanis are motivated to set aside a portion of their earnings, even if modest amounts, to finance the higher studies of their children. These savings are earmarked for unforeseen contingencies, as well as education, in the spirit of the maxim: ‘Saving for a rainy day!’

Omanis adopt different methods to save for the higher education of their children. Most common is a type of recurring savings account designed especially for educational purposes. In this type, part of the monthly income is automatically transferred into the special savings account on a recurring basis. Others choose to participate in informal savings schemes and education-related insurance programme that guarantee the nominee a university education in the future.

All the while, parents help inculcate in their children the value of money, the importance of thrift, the habit of

saving, and the ills of lavish spending, especially on unnecessary goods. They also encourage their wards to manage their finances judiciously. Pocket money that may be disbursed at certain intervals is neither excessive nor inadequate.

Instead, it will be just enough to meet the child’s basis needs.

This habit of savings also stems from a desire to ensure one is able to make ends meet amid rising expenses, particularly in the private education sector. There is a current boom in the numbers of kindergartens, schools, colleges and private universities, alongside government educational institutions at various levels, which offer free education from kindergarten to university.

Less than 8 per cent of those polled in the academic survey were not in favour of saving for the higher education

of their children. This segment perhaps falls in the low income category who cannot afford to save for their children’s education.

However, they are well aware that the government allocates sizable funds for the education of citizens in

schools, colleges and public and private universities across Oman, to enable all citizens to enroll their children in these institutions to pursue academic and higher studies. This can be a factor in this segment’s limited appetite to save for the education of their offspring.

Generally speaking, savings are an integral part of a family’s finances and an important means of funding

development in many countries as well. Islam, as well as various other religions, philosophies and laws, espouse the culture of saving. Countries and governments around the world also urge their national populations to develop the habit of saving, not only for their personal good, but for the domestic economy as well.

Indeed, the practice of saving is as old as humanity itself, based on the recognition that setting aside some money during the good times will come in handy in times of distress, destitution and hardship.

The concept of savings requires increased awareness and education among members of society in general and families in particular.

The head of the household must take the lead in drawing up an account of expenses for the month and stay within budget, eschewing any temptation to spend on wasteful and unwanted luxuries.

Children should also be encouraged to sacrifice any desire for luxuries, thereby helping the household save for the future.